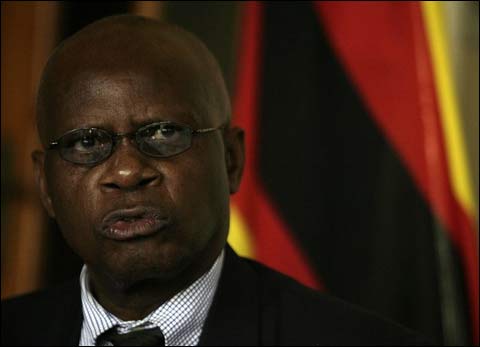

THE Institute of Chartered Accountants of Zimbabwe (ICAZ) has proposed several changes to the country’s tax regime ahead of tomorrow’s national budget as the country looks up to Finance and Economic Development minister Patrick Chinamasa for post-election measures to drive the economy.

Business Reporter

In a letter written to Finance secretary Willard Manungo recently, the country’s oldest accountancy organisation said Treasury should lower income tax to boost domestic consumption against the backdrop of an underperforming economy.

Experts say the current income tax thresholds have resulted in skills flight as professionals seek better employment opportunities outside the country.

The government, ICAZ further proposed, should postpone the introduction of the new Tax Act and the New Income Tax Act to 2015 from 2014.

ICAZ said the above taxes should be implemented when all the grey areas have been clarified.

“To boost employment, there is need to consider bringing the rate of tax on employment income (which excludes 15% value added tax (VAT))down in line with the tax rates applicable to business income, which avoid VAT, unless exempt services (are) provided or costs mainly in the form of labour employment,” reads the letter in part.

“Either corporate rates must be increased or employment rates be reduced. Preferably the latter as excessive payroll taxes increase employment costs, discourage employment of labour and make Zimbabwe’s labour intensive service or manufactured exports uncompetitive. Reduced labour costs will also increase taxable income.”

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

ICAZ also said that an allowable deduction be provided in the Act for the costs of indigenisation compliance including the making of a donation to a community share ownership scheme.

Under the country’s empowerment laws, foreign-owned firms should sell 51% to locals. The body also said capital gains tax be exempted on the disposal of shares pursuant to compliance with indigenisation laws.

“Furthermore that community share ownership schemes or trusts and employee trusts be exempted from the residents tax on dividends. This is necessary to align fiscal policy with government policy,” part of the submission reads.

The accountancy body also called for the raising of VAT registration threshold to $240 000 per annum from $60 000 in line with the threshold for the registration of fiscal devices. ICAZ also called for the reduction in $30 per day for penalty submission of returns as they are draconian.

“Penalties of 200% for VAT, PAYE, income tax and other withholding taxes and three times the duty paid value for income tax must be reduced as they are prone to abuse and can trigger corruption,” reads part of the report.