CONCERNS have been raised that the entrance of Econet Wireless Zimbabwe into the formal banking via its subsidiary Steward Bank, which facilitates the EcoCash mobile money service, will eventually trigger a mass migration from other local banks, threatening their survival. BATANAI MUTASA OWN CORRESPONDENT

The telecoms giant has been criticised by some quarters for tilting the playing field to its advantage and warnings of a possible monopoly in the banking industry have been issued since Econet is also the largest telecommunications company by market share and capitlisation.

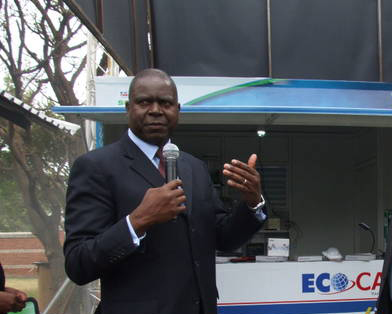

Earlier this year, Econet’s group CEO Douglas Mboweni told parliamentarians at a familiarisation tour of the company that EcoCash had handled transactions in excess of $4 billion since the service was launched in 2011.

He pointed out that 170 million transactions were handled by the operator’s 10 000 agents with an impact to 4,2 million people or 53% of the adult population.

However, renowned veteran economist John Robertson told Southern Eye Business that the large volumes of people shifting to mobile banking would only be significant if they also moved a large proportion of the money circulating in the country.

“EcoCash transactions constitute a very small average of the money in circulation because large transfers, especially from business, which involve over 80% of money, are still done through normal banking systems,” Robertson said.

“Although people have been moving to mobile banking, there is one advantage which traditional banks still possess, and it is their ability to offer loans.

You might have a cellphone to make and receive payments but if you sometimes need credit, there is difficulty in borrowing,” Robertson said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

He added that Steward Bank could start lending, but the money would be very limited to individuals although the bank could lend to other banks since the Reserve Bank of Zimbabwe, which is the lender of last resort, was not yet capacitated to carry out its mandate effectively.

In response to the possibility of an uncompetitive monopoly being created by the mobile network giant in two strategic sectors of the economy, Robertson said competitors should work hard and keep abreast of technological developments.

“There are no restrictions laid down to stop other banks from adopting mobile services and with such openness, anyone can get into the industry. For example, most banks now have cellphone banking where people can access their account regardless of which service provider they use,” he added.

During the tour with parliamentarians, Mboweni also dismissed commonly held beliefs that the EcoCash platform favoured the group’s subsidiary Steward Bank saying 10 commercial banks were integrated to the EcoCash system.

Robertson indicated that the general public’s preference of mobile banking was a result of easier cost structures to clients but underlined the effect of people’s increased need to regulate personal movement.

“In the past, people were very flexible and could travel to deliver and withdraw cash but now what people need is to make transactions with the least movement.

“My advice to competitors in the industry would be that they should not let changes go on without them because trends are moving fast and in the next five years, we cannot even predict what the environment will be like,” Robertson said.