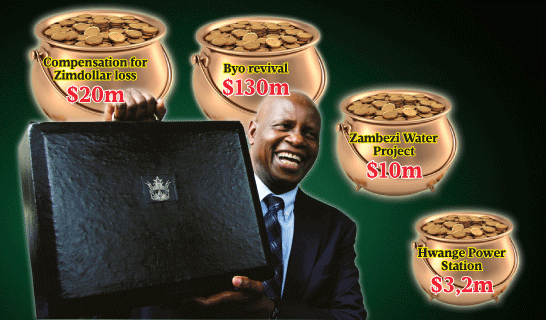

FINANCE minister Patrick Chinamasa yesterday announced a $4 billion populist budget for 2014 in which he said the government would reimburse thousands of depositors who had their local savings wiped out after the introduction of the multiple currency system in January 2009.

NQOBILE BHEBHE CHIEF REPORTER

Chinamasa said $20 million would be needed to compensate depositors who lost their money after he introduced the multiple currency system a month before the consummation of the coalition government between Zanu PF and the two MDC formations.

“It is imperative that the Zimbabwe dollar is demonetised and that Zimbabwe dollar balances, including Zimbabwe dollar Paid Up Permanent Shares (PUPS), balances are converted to US dollars for those accounts in financial institutions’ books as at 31 January 2009,” said Chinamasa.

“This measure, apart from reassuring the public that the multi-currency system is here to stay, will go a long way in compensating the public who lost their money as a result of hyperinflation. An indicative amount of $20 million is required for this purpose,” he said.

He added that the government would rectify the situation by March 31 2014 through the issuance of Treasury Bills to financial institution.

Chinamasa was also quick to state that the multiple currency system was there to stay as the new Zanu PF government attempts to address the myriad socio-economic woes bedevilling the country premised on a new economic blueprint dubbed Zim Asset and used the occasion to squash wide speared speculation that the government would reintroduce the Zimbabwe dollar.

He further pledged a cocktail of intervention measures to revive the economy which he said “was dead” adding that a new one “is being born”.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“We are a serious government. We have no fear of correcting our mistakes. The government has continued to reassure the market that the multi-currency regime is here to stay.

“This is against a background of speculation and reports to the contrary which are clearly unfounded and can only be motivated by intentions to undermine confidence in our economy.

“This position, I must add, is anchored in our Zim Asset blueprint and as a matter of fact, depending on size or volume of trade flows, I would be persuaded to introduce other foreign currencies to the cocktail of multi-currency regime currencies, if conditions warrant,” he said.

Based on the projected nominal gross domestic product (GDP) of $14,065 billion, the 2014 budget would be anchored on revenues of about $4,120 billion (29,3% of GDP), up from the expected $3,722 billion by the end of 2013.

However, Chinamasa said he was against ministries bids of about $8,9 billion, excluding employment costs, requiring some rationalisation and reprioritisation of various programmes.

He also said the government would capitalise the Civil Service Housing Loan Scheme, which acts as a non-monetary incentive for members of the civil service.

According to the budget, Chinamasa proposed to extend suspension of duty on motor vehicles used by safari operators for a further period of 12 months; proposed to levy an intermediated money transfer tax of $0,05 per transaction whenever a transfer of funds occurs between two persons using the mobile platform service.

The government also proposes to exempt electricity imports from value added tax aimed at releasing funds to enable the Zimbabwe Electricity Transmission and Distribution Company to focus on maintenance works and replacement of aged equipment.