ECONOMISTS, industrialists and labour experts warned of trouble for the country at the beginning of 2014, and true to their projections, many companies slipped into liquidation or judicial management, throwing thousands of people out of work and invariably pushing the unemployment rate close to 90%. BATANAI MUTASA/ MTHANDAZO NYONI

A quarter by quarter review indicates how the year, which was characterised by reports of abuse of office and fraud, proved difficult for business and the economy in general.

During the first quarter, former Premier Service Medical Aid Society chief executive officer Cuthbert Dube was relieved of his duties over a salary scandal after it was publicised that he was drawing a staggering $535 000 per month.

Many executives were sucked into the fiasco. The Bulawayo City Council demanded the salary schedule for executive managers in the wake of reports that their Harare counterparts were creaming it with hefty pay and allowances.

Not to be outdone, suspended Zimbabwe Broadcasting Corporation chief executive officer Happison Muchechetere was earning about $40 000 a month while the public broadcaster was struggling to pay workers.

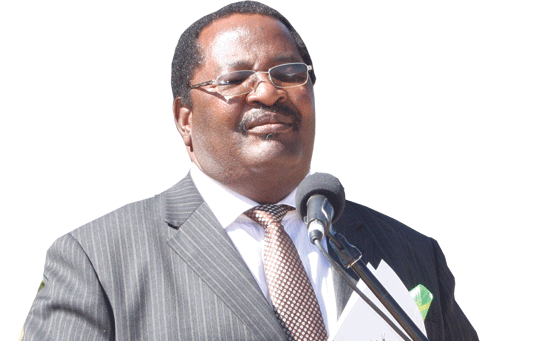

Politicians were under probe as Transport minister and Zanu PF politburo member Obert Mpofu was forced to defend his wealth after people questioned him with some local and international organisations accusing him of looting diamonds in Marange during his tenure as Mines minister.

Amid the hype around prominent people and their wealth, the Reserve Bank of Zimbabwe widened the multi-currency basket to include four more foreign currencies in what analysts saw as a way of addressing the cash shortage in the economy.

Currencies from China, India, Japan and Australia became legal tenders, alongside the greenback, South African rand, Botswana pula, British pound and the euro. However, the public is yet to see these additional currencies in circulation.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The quarter closed on a relative high with the International Monetary Fund indicating Zimbabwe was expected to register moderate growth in the short term, but the country was said to be vulnerable to weakening exports.

In the same vein, the second quarter kicked off on a positive note for business after the Zimbabwe International Trade Fair closed with a flurry of promises by both the government and investors while people who thronged the fair said this year’s event was better and more exciting as compared to the 2013 edition.

However, during the quarter, Finance minister Patrick Chinamasa admitted the government was struggling to pay workers and relied entirely on tax remittances, resulting in frequent changes to pay dates.

Although the Zimbabwe Revenue Authority passed its revenue collection target for the first quarter by 2% to $834,6 million, the achievement was described by commissioner-general Gershem Pasi as a “miracle” in the wake of the economy’s poor performance.

Strong armed by the failing economy, President Robert Mugabe then appealed for more foreign direct investments to stimulate Zimbabwe’s underperforming economy, promising to respect property rights for investors.

By the time employees were celebrating Workers’ Day, the Zimbabwe Congress of Trade Unions said the country would commemorate the day under difficult conditions with the plight of workers having worsened compared to the previous year.

Much expectation for development was hinged on the African Union Sports Council Region 5 Under-20 Youth Games held in Bulawayo this month, but in May the budget for the games was reduced downward from a staggering $46 million to $16 million after the organisers shelved plans to construct new games village at the National University of Science and Technology.

On the background of subdued economic performance, the third quarter of the year saw most industries and companies releasing half-year reports and the picture remained gloomy across the board.

Delta Corporation, the country’s largest beverage manufacturer, reported that lager volumes for the six months to September were down 25% to 69,5 million litres on the back of an underperforming economy.

It said the half-year lager volumes came off a post-dollarisation peak of just over 100 million litres registered during the 2013 financial year.

The company said second quarter lager beer volumes fell 29% below the same period last year, pushing half-year revenue 4% lower and reflecting weakening consumer demand as the economy remained depressed.

Another commercial giant, Econet Wireless Zimbabwe, reported a 30% decline in after-tax profit to $49,6 million for the six months to August compared with the same period last year as revenue growth continues to slow down, in the company’s financials released in October.

Labour lawyer Rodgers Matsikidze noted that some local companies were taking advantage of the prevailing harsh economic climate to trample on employees’ labour rights in a clear violation of Zimbabwe’s labour laws.

Struggling mining giants Hwange Colliery Company promised to settle outstanding salaries in the period to September if efforts to recapitalise bore fruit.

The company was reported to be technically insolvent owing workers $19 million in unpaid wages for 11 months. In October last year, it sent 1 000 employees — a third of workforce — on unpaid leave after the overdue wage bill climbed to $14 million.

Employees were not the only ones to bear the brunt of an ailing economy as even hospitals ran out of drugs with sacked Health and Child Care deputy minister Paul Chimedza saying government hospitals were operating with less than 50% of required drugs due to lack of adequate funding.

Adding salt to injury, tourism, which was targeted to immensely contribute towards economic revival, received a major dent with the Zimbabwe Tourism Authority chief executive officer Karikoga Kaseke saying the country lost business worth $6 million since the outbreak of the highly contagious Ebola virus in March, which resulted in limited international travel.

About 30 foreign buyers withdrew participation from this year’s Sanganai/Hlanganai World Tourism Expo held in October.

Despite all the misery, the quarter had a silver lining as the European Union lifted the 12-year suspension of direct financial aid to the government in October.

The bloc said it would, from 2015, start a €234 million ($300 million) five-year funding programme to support health, agriculture and governance initiatives.

In the last three months of the year, highlights were the Finance ministry’s 2015 budget proposal and the RBZ’s attempt to regularise trade bottlenecks by introducing bond coins.

But the political situation in the country overshadowed economic activity as the country focused on turmoil in the ruling Zanu PF party.

Announcing the 2014 national budget in November, Finance minister Patrick Chinamasa explained the downward spiral of business saying in 2012; 1 464 companies shut down, leaving 20 825 employees jobless while in 2013, 878 companies closed shop