The Monthly Financial Sector Bulletin (MFSB) publishes “The Microfinance Interview”, a monthly question-and-answer feature through which it engages with key stakeholders of the microfinance sector such as microfinance institutions (MFIs), funders, service providers, development partners and regulators among others, on issues of topical and mutual interest.

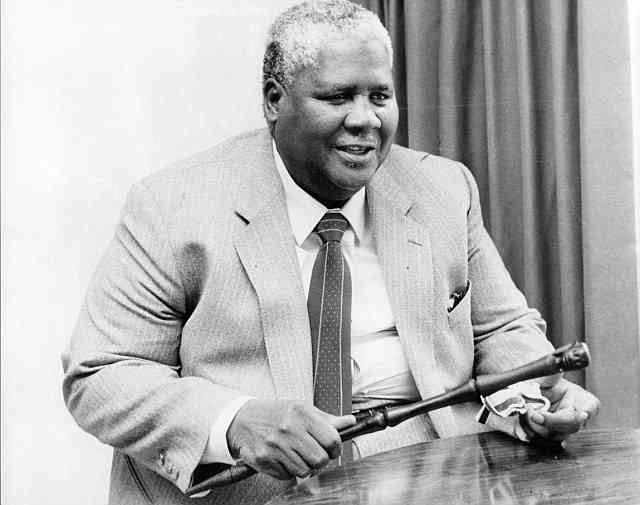

Financial Spotlight: Omen Muza

In the fourth instalment, Microcred Zimbabwe chief executive officer, Lloyd Borerwe (LB) talks to NewsDay’s financial columnist Omen Nyevero Muza (ONM) about the MFI’s business model, post-acquisition value creation initiatives to put the company back on a sustainable growth path, the importance of strong shareholder support on corporate performance as well as challenges and opportunities. He also outlines the role digital finance can play in meeting the microfinance sector’s financial inclusion goals and the company’s views on external ratings. Below are excerpts of the interview.

ONM: Against the background of what many consider to be a worsening operating environment in Zimbabwe, could you put into context the company’s payoff line, “think bigger”?

LB: Our tagline is unique. It communicates our commitment and expresses our engagement. It captures our values and expresses our drive. It means thinking differently and not being limited by what already exists. There can never be any perfect operating environment. It is important, therefore, for any business small or great to find a winning formula to ensure its corporate objectives are achieved to the satisfaction of all its stakeholders.

ONM: Can you outline the importance of strong shareholder support on the performance of Microcred, given the current operating environment in Zimbabwe?

LB: If you consider that our current shareholders have a proven record of accomplishment and footprint of establishing, supporting and sustaining microfinance business operations, then you can expect Microcred Zimbabwe to benefit immensely from this wealth of experience. Looking at our Zimbabwean context more specifically the microfinance sector, the market is capital-starved and in need of proven and cost effective business models to better serve the informal sector. I believe we have the right mix of shareholder support any company would hope for in order to make it.

ONM: It is almost a year since the acquisition of MicroKing Finance (Private) Limited by Microcred SAS and AfricInvest Financial Sector Fund Limited was concluded on May 23 2016. Considering that the franchise had lost significant value, what post-acquisition value creation initiatives have you embarked on to put the company back on a sustainable growth path?

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

LB: First things first, it was necessary to ensure institution-wide stability was achieved within the minimum possible time post-acquisition. We embarked on quite a number of initiatives as part of our value creation process.

We have just recently concluded rebranding and the brand activation exercise. This was at the centre of our value creation process. Our objective has been and still remains repositioning ourselves and redeeming lost market share and to achieve this, we had to look at a number of value creation stimulants that included but where not limited to 1) Reviewing and resourcing of our organisational structure with skilled and competent personnel; 2) Training and development of existing and new staff; 3) Review of our key operational policies and processes and 4) Product and branch rationalisation. These and other initiatives have laid the bedrock on which to sustain our growth going forward.

ONM: I understand that the new shareholders have since provided both equity and debt funding to support the institution’s underwriting capacity. Are you at liberty to disclose the amounts involved? LB: The amounts provided both in equity and debt has been significant enough to meet the institution’s financial and operational needs.

ONM: What’s your view on the regulatory authorities’ cap of 10% interest on loans by MFIs? LB: Interest rates are a function of a number of factors. Within our sector, I would put cost of funds, scale and cost-effective business model, as the most important in determining cost of products offered by MFIs. An institution that can strike a balance on these will be very competitive and responsible when it comes to pricing.

ONM: Apart from the change of name, what else has the recent rebranding brought to your company? What are you going to do differently?

LB: The name change is just a sign of greater institutional change that has taken place and that has ultimately translated to a better and richer value proposition for the benefit of clients and stakeholders. Microcred is the same wherever you go — it was needful, therefore, for Microcred Zimbabwe to go through the comprehensive rebranding process to ensure brand uniformity and standardisation. Our differentiation is stemming from our brand promise, persona and elements. We now have an enriched brand promise. Focusing exclusively on enterprise lending, we want to help our clients “build today for their future” and to deliver this promise we have reviewed our products, business processes. Looking at our people (staff), we have invested a lot in fostering a new corporate culture and remodelling of our branches to have the ideal and excellent physical evidence at all our customer touch points. In short, our way of doing business has completely changed.

ONM: What role, in your view, can digital finance play in meeting the microfinance sector’s financial inclusion goals?

LB: Digital finance is a key enabler of financial inclusion. The main concerns around reaching out to the low income and informal markets have always been achieving scale, ensuring convenience and lowering transactional costs. Digital finance can support and complement innovative solutions to some of the teething problems and hurdles that traditional models have in promoting financial inclusion.

ONM: The Microcred Group says it is one of the few global companies to have succeeded in deploying a profitable model for financing MSMEs. What is this success largely attributed to?

LB: Any model must be time tested, and the Microcred model has stood the test of time. The success has largely been attributable to a number of factors, but I will just mention a few. The first has been premised on managing credit risk. A solid underwriting procedure is the starting point to building a profitable model that ensures long-term sustainability of the institution. Secondly, the Group has managed to foster high levels of productivity. This has largely depended on building a skilled human resources base and complementing this with effective business processes. Operational excellence is what will ensure any institution achieves scale profitably.

ONM: Microcred only provides business loans for developmental or productive purposes as opposed to consumer lending. What do you have to say about the view that some loans acquired under the “consumer lending” banner are actually deployed for productive purposes?

LB: Well, my view is that this is subjective and depends on the school of thought you come from. When we consider productive lending, you actually verify and access the enterprise in question. Eventually one knows for certain that the client is engaged in productive activities and that is exactly what you are financing. It a different perspective altogether when you consider salary-based/consumer lending, the basis of classification of loan use is primarily based on what the client writes on the application form. In most cases, that is not followed through and is not the basis of assessment.

ONM: What’s the current size of Microcred’s branch network and are there plans to expand to other centres countrywide?

LB: Microcred Zimbabwe currently has a footprint of 9 branches and there are plans to expand to new centres that have ranked high in terms of potential. Each case is looked at based on the merits of the (its) business case.

ONM: Does the company have plans for converting its credit-only licence into a deposit-taking one and if so, what is the strategic imperative for this?

LB: Most certainly, this is something that the company is planning to do. This is purely informed by the need to enrich and deepen the institution’s outreach.

ONM: At the last count, out of the 173 registered MFIs in Zimbabwe, about six had either been rated or were currently undergoing the rating process. First, what’s Microcred’s view on the issue of ratings and second, why do you think there is such a big gap between rated and unrated MFIs?

LB: When you consider the need for MFIs to attract international lines of credit, ratings can raise the profile and credit worthiness on an institution. The rating process can actually result in improved operational best practice within an institution. The latter depends largely on commitment and willingness of the leadership.

ONM: As you angle to put the business on a sustainable growth path, what would you say are your biggest challenges?

LB: The greatest challenge any institution can face is remaining relevant in a changing and competitive environment. Staying ahead of the pack in my view will be the greatest challenge.

ONM: What opportunities do you see in the local market?

LB: The local market presents huge opportunities. When you look at the need for access to credit, there is still greater potential for deepening penetration. The cake is just so big.

Omen N. Muza edits the MFSB. You can view his LinkedIn profile at zw.linkedin.com/pub/omen-n-muza/30/641/3b8 or initiate contact on [email protected].