CEMENT volumes at PPC Zimbabwe, the country’s biggest cement maker, continued to show strong growth, increasing 41% in the 10-month period ended January 31, 2024, albeit slightly lower than the comparable period.

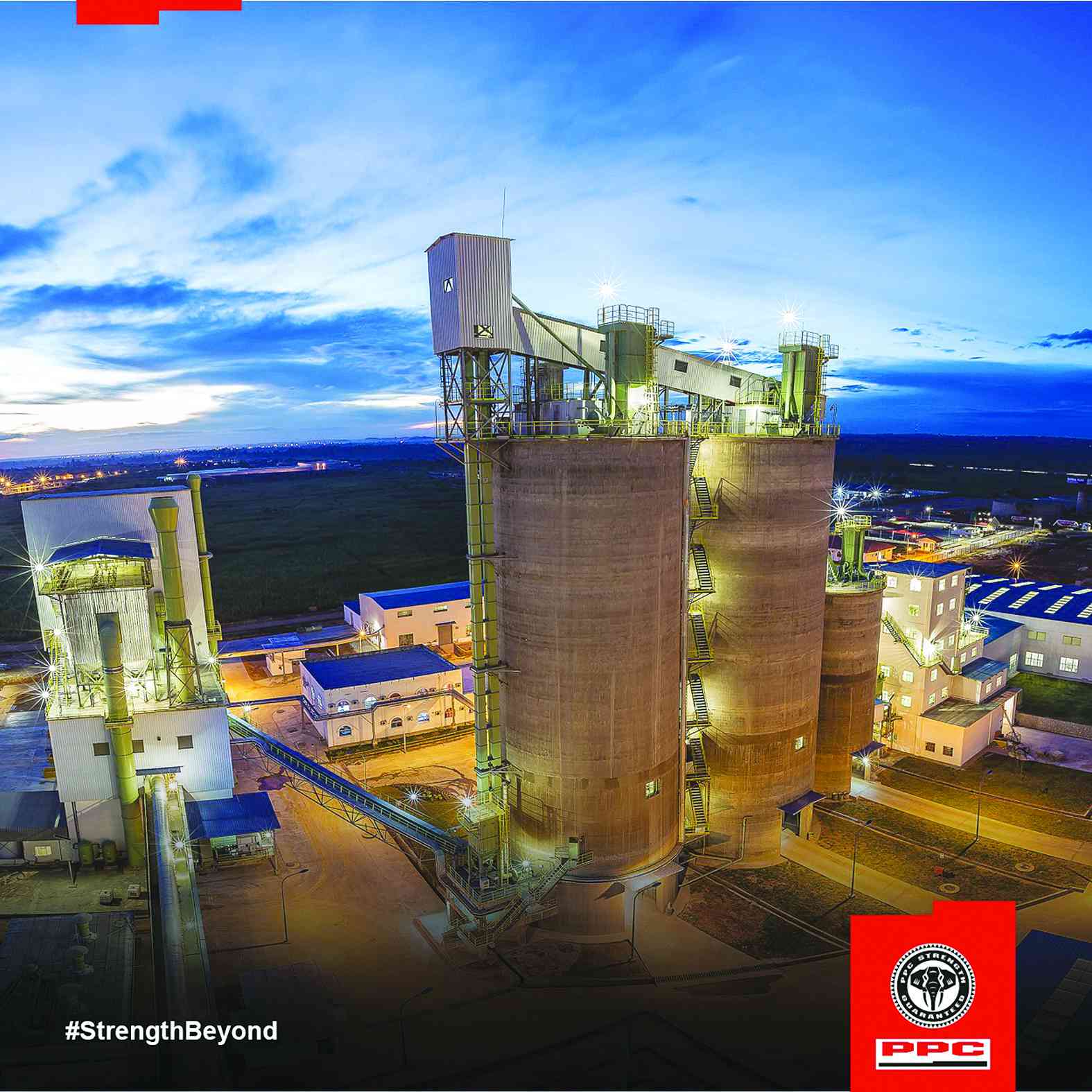

PPC Zimbabwe operates a clinker plant at Colleen Bawn in West Nicholson and milling plants in Bulawayo and Harare and is part of a bigger empire, PPC Limited, whose headquarters is in South Africa.

Apart from South Africa and Zimbabwe, PPC Limited also has a footprint in Botswana, Ethiopia, the Democratic Republic of Congo and Rwanda.

PPC was suspended from trading on the Zimbabwe Stock Exchange in 2020 alongside seed producer Seed Co International and Old Mutual Limited.

The suspension was a result of government’s suspicion that fungible counters were aggravating the depreciation of the domestic currency, which has been falling since 2016.

“Growth continues to be as strong as result of both residential construction and government funded infrastructure projects, constrained imports and a low base in the comparable period due to the extended shutdown,” parent company PPC Limited said in an operational update for the 10 months ended January 31, 2024.

“EBITDA [earnings before interest, tax, depreciation and amortisation] margins were 22% in the current period, an improvement from 18% in the comparable period, but lower than 25% at the half-year. This was mainly due to the high cost of clinker imports as local production could not meet demand levels.”

Zimbabwe continues to remain debt free and held R95 million (US$5 million) in unencumbered cash at January 31, 2024.

- Inaugural Zim investor indaba highlights

- Stop clinging to decaying state firms

- ZB explores options to tackle inflation

- Zim operations drive FMB Capital

Keep Reading

Group revenue increased by 27,6% for the period under review compared to the prior period.

“This was driven mainly by continued strong growth in PPC’s Zimbabwe operations relative to the low base in the comparable period,” it said.

This was higher than the 22,1% revenue growth to the end of September 2023 compared to the six months ended September 30, 2022 calculated on a consistent basis to exclude CIMERWA.

Revenue growth in the South African and Botswana cement business continued to be driven by price increases, positively offsetting the declining sales volumes as experienced in the half year.

Group EBITDA margins improved to 13,6% in the current period from 9,9% in the comparable period.

However, this is lower than the half-year EBITDA margin (excluding CIMERWA) of 15,3%.

“The decrease in margins compared to the half year is due to lower South Africa cement margins, a weak performance in the materials business, one-off costs at a group level as well as marginally lower EBITDA margins in the Zimbabwean operations.”

PPC said capital expenditure for the group remains behind the guidance of R600 million (US$31,6 million) for the full financial year mainly due to the delay of the fly ash project (expansion capex) in Zimbabwe.

“This is a timing issue due to a delay in accessing the power plant to complete the plant design and commercial contract. This is now expected to commence early in FY25 (financial year 2025) as opposed to FY24, thereby delaying the benefits of this expansion project for approximately one year,” it noted.

PPC Zimbabwe declared dividends of US$4 million in July 2023 and US$7 million in November 2023.

The short-term outlook for PPC Zimbabwe remains positive, while for the South African and Botswana markets it remains subdued, PPC Limited said.