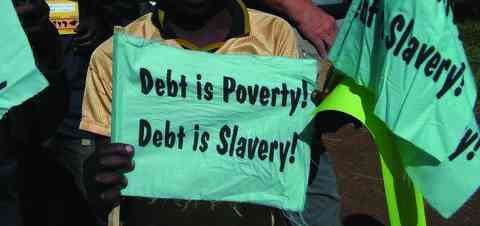

LAST week, the column highlighted that Africa is trapped in debt, and this is helping sustain high poverty and vast inequalities. High indebtedness heavily constrains the countercyclical effects of fiscal policies and impedes domestic capital accumulation by heightening interest, tax, and inflation rates.

However, it is worth noting that creditors are also playing a significant role in burdening developing countries with unsustainable debt. This assertion can be linked to the historical design of the present-day global financial system (GFS).

The literature explains GFS as a complex network of financial institutions, markets, and instruments that enables the flow of capital and resources within a country and across international borders.

Furthermore, it is explained that GFS outlines rules of engagement between nations through the balance of payments and their monetary authorities, such as central banks, treasuries, and stabilisation funds managing them.

The preceding paragraphs makes it clear that the GFS is crucial in facilitating global investment, promoting international trade, and distributing wealth among nations. While GFS is critical for sustaining economic growth and stability in developing countries, it can be a potential source of financial instability and contagion risks if poorly managed.

In the succeeding paragraphs, I seek to highlight some of the contributions of the current GFS to the mounting African debt problem.

High borrowing costs

The developing world is experiencing complex challenges, including rising inequality, climate change, increasing systemic risks, financial markets vulnerable to cross-border contagion, entrenched gender bias, conflicts, and geopolitical shifts threatening sustainable development.

- Dual economy Zim’s Achilles heel

- Village Rhapsody: How Zimbabwe can improve governance

- Dual economy Zim’s Achilles heel

- Scrap IMTT to save industry, govt urged

Keep Reading

The global shocks — liquidity crunch, natural disasters, and pandemics — are gradually making even well-managed debt unsustainable, ballooning the cost of debt refinancing to unsustainable levels.

As a result, many low-income countries are in debt distress. Almost 40% of all developing countries (about 52 countries) are experiencing severe debt-related challenges and expensive market-based financing.

Although these countries account for a paltry 2,5% of worldwide output, they constitute about 15% of the global population. They are more than half of the world’s most climate-vulnerable countries, and account for 40% of all people living in abject poverty.

So, high borrowing costs in capital markets are curtailing Africa’s ability to invest in recovery and support sustainable growth and development. Debt gravely subdues a nation’s ability to curb societal inequalities, invest in climate and sustainable environment, and critical social services like health and education.

For instance, United Nations statistics show that in 2023, approximately 14 countries’ sovereign bond yields exceeded the yields on United States (US) Treasury bonds by more than 10 percentage points, while 21 countries had sovereign bond yields exceeding US Treasury bond yields by at least six percentage points. This high borrowing cost increases the risks of future debt crises.

The existing financial architecture fails to support the mobilisation of stable and long-term financing needed to fight rising global debt challenges and achieve the United Nations (UN)'s Sustainable Development Goals (SDGs) for all people.

Instead, creditors charge higher interest rates on loans provided to developing nations, with many governments forced to allocate a high share of revenue to debt service payments instead of investing in critical social services.

Also, because of high indebtedness leading to defaults, many African countries are experiencing high borrowing costs, including excessive interest on arrears and penalties.

Yet, without fair, rules-based global financial architecture, debt resolution has typically been too little, too late.

The debt restructurings offered by creditors are inadequate to provide a clean slate and avoid repeat crises, which often materialise too late with protracted high social costs.

Variations in access to liquidity

The current global financial architecture has massive variations in countries’ liquidity access during crises. In 1968, the International Monetary Fund (IMF) created the special drawing rights (SDR) system to supplement official reserves and facilitate global liquidity.

But the allocation of SDRs tends to disproportionately benefit countries that are less in need as they are distributed in proportion to existing IMF quotas.

The IMF quota system is primarily a function of an economy’s size and relative position in the world economy.

For instance, in 2021, the IMF issued a record US$650 billion in SDRs to help member countries combat the devastating impacts of the Covid-19 pandemic.

Despite rich nations being the least likely to require or utilise these SDRs, they got approximately US$450 billion.

This allocation constituted 70% of the total general SDR allocation, while Africa, with a population exceeding 1,4 billion, got fewer SDRs than Germany, with a population of 83 million.

Many advanced countries’ SDRs are never fully utilised and are kept as reserves.

Yet developing nations struggling with debt distress were forced to borrow more to meet the demands created by the Covid-19 pandemic.

For instance, World Bank statistics show that the debt burden of more than 70 low-income nations increased by a record 12% to US$860 billion in 2020.

This exacerbated the debt crises and further subdued the capacity to service and repay the debts.

Conditionalities

The debt provided by almost all creditors has some conditions attached. The design of creditor-supported programmes has conditions: macroeconomic, structural, fiscal, and monetary policy conditions.

Despite justification for setting these loan conditions, policies championed by multilateral institutions are viewed sceptically in many developing nations.

The ensuing austerity measures from these policies entail increases in taxes, including high user fees in the education and health sectors, deregulation, and downsizing of government through withdrawal of subsidies, reduction of civil service, and commercialisation and privatisation of critical state-owned enterprises.

Without establishing strong social safety nets, these reforms disproportionately impact low-income people, who rely heavily on public services.

This was significantly attested by the IMF-led Economic Structural Adjustment Programme (Esap) implemented by Zimbabwe in the 1990s.

The Esap reforms contributed to deindustrialisation, increased informalisation, high unemployment, increased exchange rate depreciation, rampant inflation, and increased poverty and marginalisation.

A leaf from history shows that most of the developing countries that implement creditor-sponsored blanket policies would end up borrowing more for social protection to cushion vulnerable citizens and marginalised and underserved communities.

Under-investment

Most of the debt provided by creditors did not fund global public goods like climate action and pandemic preparedness.

Also, for a long time, the debt sustainability analyses by GFS failed to incorporate climate risks and their impact on long-term investments to gauge the positive effects of these investments on productivity and resilience on debt sustainability.

More so, the debt sustainability assessments did not reflect countries’ SDG financing needs as they failed to incorporate fiscal space for investments in the SDGs.

The current seniority system prioritises payments to external creditors instead of giving seniority to social protection obligations and payments related to other pressing domestic needs.

In 2023, the UN posited that although giving seniority to social protection obligations would increase the risk of default, it would more accurately reflect how much of a write-down is necessary when defaults occur.

As such, multilateral institutions should change business models to ensure all their lending has a sustainable development impact.

This can include re-orientation of allocation of concessional finance to indicate vulnerabilities such as climate disasters and support for conflict-prone countries.

Resource-backed loans (RBLs)

Due to high indebtedness, several African countries are experimenting with the RBL model. In this model, natural resources can serve as payment in kind, the resource of an income revenue stream used to make repayments or an asset that serves as collateral.

In other words, resource-backed loans (RBLs) are loans given to a government where repayment is either made directly from natural resources or a resource-related future income stream.

The debt overhang has directly impacted capital inflows and led to a vicious debt cycle in Africa — the cycle of continuous borrowing, accumulation of payment burden, and eventual default.

This has caused borrowing countries to lose access to global capital markets and suffer higher borrowing costs, harming growth and investment.

So, to reduce the impact of the debt cycle, the RBLs have become more appealing to cash-strapped African governments already facing distressed debt levels. At the same time, predatory creditors are taking advantage of a debt crisis in Africa, thus aggravating the situation.

Parting shot

The column highlighted that as much as Africa faces many internal troubles, including, among others, fragile politics, corrupt leadership, populist policies, tribal conflicts, and financial repression that have contributed to the debt crisis, external creditors have also played a significant role.

- Sibanda is an economic analyst and researcher. He writes in his personal capacity. — [email protected] or Twitter: @bravon96.