THE Concise Oxford Dictionary defines debt, as something owed especially money, while relief refers to the alleviation of or deliverance from pain.

On the other hand relief is viewed for example as financial assistance given to those in special need or difficulty, with rent relief given as an example. On the other hand cancellation denotes the act or an instance of cancelling or being cancelled eg cancelling a booking or reservation.

When the Local Government minister pronounced that ratepayers who owed local authorities monies had been absolved of any indebtedness, questions were raised over the intention and implication of the said directive.

As alluded to earlier on, debt relief refers to alleviation or deliverance from pain. Alternatively, it is assisting someone, out of a financial crisis that one would have gone into.

The impression deriving from this definition is nowhere near cancelling the debt. If anything, it is about helping someone liquidate the said debt.

Cancellation denotes a reversal of an act, a good example is cancelling a booking or reservation. The implication of a cancellation is to nullify something that exists into non existence.

In the case of local authorities, service delivery had been rendered and in turn rate payers were duty if not legally bound to pay for the services consumed or enjoyed. On the other hand local authorities owed monies to their creditors and time frames were in place as to when the said debts would be paid. Overnight local authorities found their debtors’ indebtedness cancelled.

The problem from an accounting point of view is, how does one do away with a debt without making it right? The elementary double entry system in accounting does not permit the cancellation of a debt without equating it with a credit balance which is a payment of the same.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Parastatals have collapsed, owing to this politics of deification. Principles are sacrificed at the alter of convenience and deification of political figureheads.

Freedom trains were a pleasure to ride, Zupco buses religiously ferried supporters to National Heroes’ Acre and other political appointments, as if they consumed portable water, there were no overheads and other incidental costs to be cared for. It is so sad that powers that be are bent on making every organisation an equal partner in mediocrity.

After struggling with the Zimbabwe dollar aftermath, local authorities had started breaking even. Unknown to them, the July 31 2013 bombshell was in the making.

Section 303 of the Urban Councils Act, Chapter 29:15 is very clear. It clearly states that council may write off debts, excluding rates owed it, if such amounts are considered irrecoverable or costs of recovering the same are more than the debt. Equally, the Rural District Councils Act, Chapter 29:13, Section 133 (1) and (2) empowers the rural district councils to write off debts on same provisions. Nowhere in both Acts does it empower the parent minister to cancel councils’ debts.

In spite of all this clarity of provisions of both Acts, council proceeded to execute an illegal directive, which can never stand in the path of an Act for lack of locus standi. Form a legal point of view, an illegal order must not be obeyed. When an illegal instruction is obeyed, both the instructor and instructée are at fault.

Another dimension of the problem is the paymaster and the paid relationship between councillors and the parent minister. The welfare of councillors is dependent on the prevailing mood of the minister. For fear of victimisation or loss of perks and positions, councillors have become willing servants.

Believe it or not, the majority of the current crop of councillors have been conditioned to accept that councils cannot challenge central governance and survive.

Councils are creatures of statute and not of the minister.

If there is a ministry that is shambolic, in terms of local governance it is the Local Government ministry. The minister has become an Act himself. He can hire, fire, willy nilly. He can institute Investigating commissions, whose upkeep leaves local authorities worse off than what they were before.

The restiveness being experienced in local authorities currently was to be expected. Both managements and policy makers live in constant fear of the reprisals from the minister. As a result time and energy is spent on self preservation than on service delivery.

One wonders why Parliament is not holding the minister accountable for the chaos prevailing at local authorities. Normalcy must prevail.

Local authorities have dived into a no return abyss. The only way out of this quagmire is for the government to provide grants to local authorities or inherit/ take over councils; debts as a way of crediting councils for the financial loss caused by the cancellation of debts. Reserve Bank of Zimbabwe debts have been inherited by central government, meaning that the proffered suggestion is not about inventing the wheel, but simply heeding the dictates of a good if not an indispensible practice.

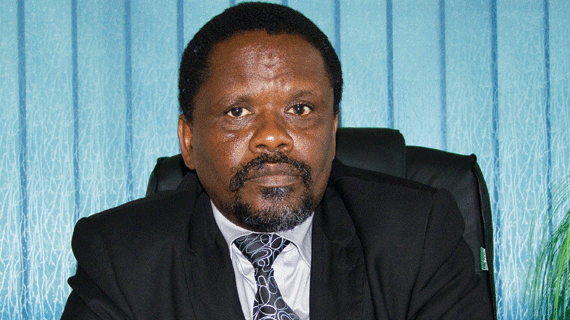

Finally, make no mistake the policy to alleviate suffering of residents by way of debt relief was a good gesture. The problem arose when debts were cancelled. Central government has no choice, but to bail out local authorities. By the way, local authorities are political springboards for sprinting to national echelons. Moses Tsimukeni Mahlangu is the general-secretary for Zimbabwe Urban Councils Workers’ Union. He is a labour consultant and arbitrator. Feedback: E-mail: [email protected]