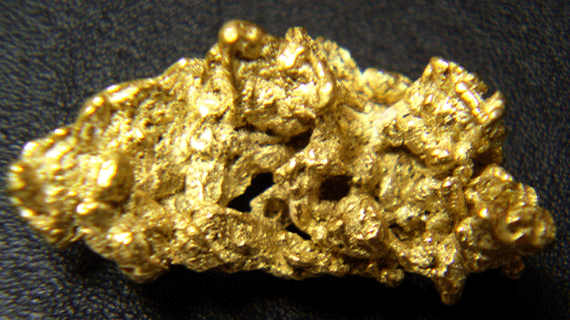

SINGAPORE – Gold clung to overnight gains yesterday to trade near a one-month high as worry over a slowdown in the global economy persisted after China’s growth eased in the third quarter to its weakest since the 2008 to 2009 financial crisis.

The weakness in Chinese growth, however, was not as bad as feared as the world’s second-largest economy grew 7,3% between July and September from a year earlier, above the 7,2% forecast by analysts. The slightly better-than-expected data yesterday lent some support to Asian equities, but investors were eyeing United States data later this week for more cues.

“For the moment I think gold will hold near the key $1 250 level and a strong break above that could take it up to $1 275,” said a trader in Hong Kong. “Despite the recent rebound in equities, there are still some worries out there that could attract bids for gold. Weakness in the dollar is a major factor for gold,” the trader said.

Spot gold was flat at $1 246,71/oz by 4:08am, after gaining 0,7% in the previous session. Gold jumped to a one-month high of $1 249,30 last week as fear over a slowdown in the global economy sent investors chasing after safe-haven assets. The dollar was little changed yesterday, but it is off a four-year peak hit at the beginning of October.

With Chinese data out of the way, the focus will now turn to tomorrow’s US inflation data and tomorrow’s European manufacturing reports.

Weak data from Europe in particular has hurt financial markets in recent days, leading to jitters about a global slowdown and a close watch on economic data.

SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings fell 1,18% to 751,97 tonnes on Monday — the biggest daily percentage drop in a year. The drop in holdings at the fund — considered influential due to its size — could undermine sentiment in the bullion market.

Traders, however, were optimistic about buying interest in the physical markets from Asia — the top-consuming region. India, the second-biggest gold buyer, celebrated Dhanteras yesterday and Diwali later in the week.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Both are considered auspicious for buying gold, and retail sales and imports could get a boost. News that India’s central bank will not tighten its gold import rules further could also lend support.

– Reuters