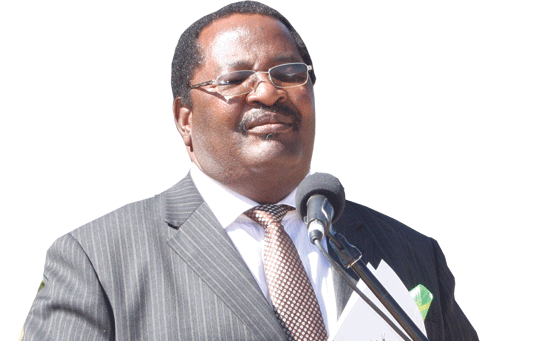

TRANSPORT minister Obert Mpofu’s Allied Bank yesterday surrendered its operating licence to the Reserve Bank of Zimbabwe (RBZ), immediately closing its doors to the public and bringing to an end its turbulent operations.

BATANAI MUTASA OWN CORRESPONDENT

Mpofu took over Allied Bank from the Zimbabwe Allied Banking Group, reportedly splashing almost $23 million for its acquisition, but from the outset it was clear he had taken over a poisoned chalice.

The failure of the bank is likely to put a dent in Mpofu’s armour as he has previously described himself as “just a shrewd businessman” when questioned about the source of his wealth.

But Mpofu’s commitment to the bank has been questionable as the RBZ revealed that the minister’s investment vehicle Trebo and Khays had failed to transfer property like York House to the bank as per agreement during the takeover.

The central bank reported frustration that little progress was being made in recapitalising the bank despite the Zimbabwe Revenue Authority (Zimra) granting a waiver on capital gains tax.

Despite its problems, the bank had sauntered on since 2012, although it was increasingly becoming evident that its demise was inevitable.

Early last year, the financial institution was reported to be under RBZ surveillance amid concerns it was facing solvency problems under limited operations.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In a public notice, the RBZ said it cancelled Allied Bank Limited’s licence in terms of Section 14 (4) of the Banking Act (Chapter 24:20).

“The cancellation followed a voluntary surrender of the licence by the banking institution,” the central bank said yesterday.

RBZ said it had determined that the bank was no longer in a safe and sound condition in that the institution was grossly undercapitalised, while facing chronic liquidity challenges.

“The Reserve Bank will accordingly hereafter, apply for the liquidation of the institution in terms of Section 57(1) (a) of the Banking Act,” said the notice.

Mpofu and his wife Sikhanyisiwe, who sit on the bank’s board, were not available for comment yesterday.

Allied Bank becomes the second financial institution in as many months to face liquidation after RBZ applied to the High Court to have Interfin liquidated.

Southern Eye Business reported last month that Allied Bank was on the verge of collapse after complaints of lack of service from clients.