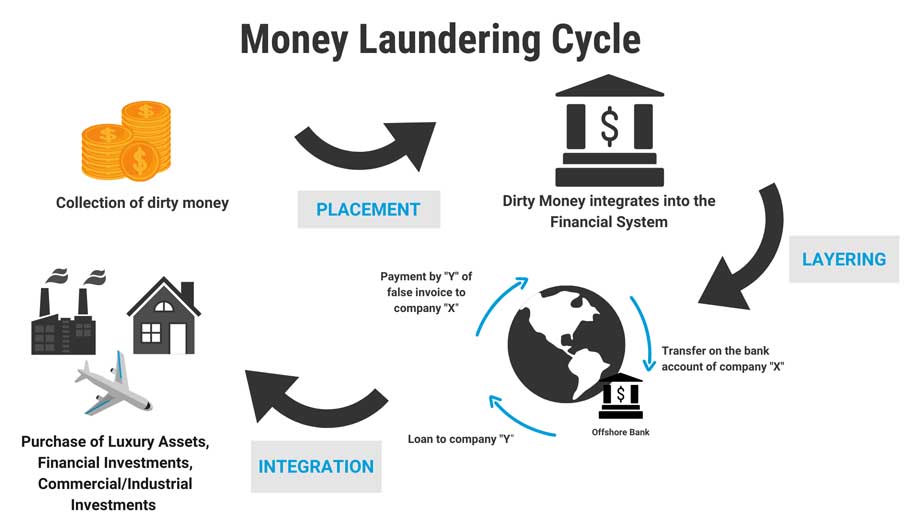

BY RONALD ZVENDIYA Money Laundering (ML) is the process by which criminals attempt to conceal the true origin and ownership of the proceeds of criminal activities.

If successful, the criminal property can lose its criminal identity and appear legitimate, meaning that criminals can benefit from their crimes without the fear of being caught by tracing their money or assets back to a crime.

Criminals are relying on established methods to launder proceeds from the illegal wildlife trade, including the placement and layering of funds through the formal financial sector.

This shows the important role that financial institutions can play in detecting suspicious activity.

In particular, countries reported that criminals involved in illegal wildlife trade are placing and layering funds through cash deposits under the guise of loans or payments, e-banking platforms i.e. electronic payment services that are tied to a credit card or bank account, licensed money value transfer systems, and third-party wire transfers through banks.

In order to conceal the sender and the receiver of the funds, and to avoid the country-specific threshold reporting by financial institutions, syndicates are relying on money mule accounts and low-value payments.

Small-scale and large-scale criminals involved in illegal wildlife trade often use shells and front companies to conceal payments and launder the proceeds of their illicit activities.

Criminals are primarily using shell companies to facilitate the transfer of value between syndicate members, between buyers and sellers, or to hold assets.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

At the same time, criminals use front companies, which generally conduct legitimate business simultaneously with the illegal activity, to both facilitate the movement of the wildlife itself and to co-mingle licit and illicit proceeds, thereby disguising the transfer of value.

Wildlife traffickers often use front companies that have connections to import-export industries to help to justify the movement of goods and payments across borders (e.g., plastics, timber, frozen foods, or artwork).

Another common trend is the misuse of front companies with connections to the legal wildlife trade, (e.g. taxidermists, farms, breeding facilities, pet shops, and zoos).

Other industries that may be more vulnerable to misuse include traditional medicine, décor and jewellery, and fashion.

Importantly, criminals incorporate shell and front companies in both source or destination countries for the illicit wildlife, but also take advantage of the weak regulatory environments in some financial and incorporation centres to set up complex company structures (e.g. multiple layers of ownership, and multi-jurisdictional).

This suggests that trade data, and information on company business activities and tax reporting, are important sources to identify anomalies and suspicious behaviour for wildlife crime.

Criminals are also purchasing high-value goods, such as real estate and luxury items (e.g., vehicles, jewellery, and artwork) to launder proceeds from illegal wildlife trade at the integration stage.

This shows the important role that certain non-financial sectors (e.g., real estate agents, lawyers, and precious metal and stones dealers) can play in detecting suspicious funds linked to illegal wildlife trade.

New technologies play an important role in facilitating communication and non-face-to-face payments between buyers and sellers for illegal wildlife.

In particular, encrypted communication platforms and illegal wildlife marketplaces hosted via social media sites, online vendor platforms, and the dark net increase the ease with which wildlife transactions can occur between buyers and sellers.

Although online listings are easily accessible, VPN connections disguise the location of wildlife traffickers who often engage prospective buyers through private groups or encrypted mobile messaging platforms.

Consequently, in the absence of regulations, law enforcement agencies rely heavily on technology companies to detect, track and disrupt illegal wildlife trade-related sales throughout the vast online marketplace.

To detect and disrupt illegal wildlife trade-related internet sales in the future, a coordinated effort is required across the public, private, and non-profit sectors.

At the same time, the evolving payment infrastructure for online sales, and its potential for significant growth, are also posing potential challenges to counter illegal wildlife trade efforts.

Within Zimbabwe, where mobile banking systems are misused to transfer payments related to wildlife crime.

The country should identify and assess its money laundering risk relating to illegal wildlife trade, including by involving relevant experts and data in the risk assessment process and should put in place mitigation mechanisms and allocate resources in line with any identified money laundering risks.

The government should ensure that law enforcement and other relevant competent authorities have sufficient resources and expertise to combat money laundering from illegal wildlife trade in line with identified risks.

This may require the adoption of national strategies and re-allocation of resources for combating money laundering and illegal wildlife trade.

In addition, the country should ensure that offences connected to illegal wildlife trade are treated as predicate offences for money laundering, as appropriate, in line with identified risks.

This should extend to conduct that occurred in another country.

For criminal investigations into illegal wildlife trade, authorities should conduct parallel financial investigations, pursue money laundering activity and seek money laundering charges where feasible.

Furthermore, prosecutors and police should obtain additional training in how to creatively use international instruments and advanced investigative techniques.

In cases of low capacity, the governments should ensure that the infrastructure required for payment of financial penalties and non-custodial sentences is established.

In order to diminish the profit motive and deprive criminals of facilitating property, when investigating illegal wildlife trade and related money laundering, competent authorities should, wherever possible, identify, freeze, seize, and confiscate associated assets, including those that extend beyond the trafficked products themselves.

Zimbabwe should consider how it can increase cooperation with foreign countries to strengthen measures to identify and combat money laundering from illegal wildlife trade.

This could involve more proactive engagement with foreign counterparts and appointing contact points responsible for financial and money laundering inquiries into illegal wildlife trade.

It may also involve organising regular bilateral or multilateral dialogues or participation in multilateral coordination mechanisms.

Importantly, these initiatives should seek to connect countries used as transit points or destinations for illegal wildlife trade financial flows with the illegal wildlife trade origin countries.

Zimbabwe should consider how it can promote public-private collaboration and information exchange, to effectively identify and address money laundering linked to illegal wildlife trade.

Given the importance of both financial and environmental expertise, it is important to consider how this collaboration can include a broad range of organizations, including from the not for profit organisations sector.

In conclusion, to combat money laundering from the illegal wildlife trade, there is a need for both a high-level political commitment and enhanced operational coordination between law enforcement responsible for wildlife crime and those working on anti-money laundering.

The public sector must work closely with relevant financial and non-financial institutions that play a vital role in detecting Illegal Wildlife Trade activity.

Therefore, reporting entities should be aware of the risks of new technologies being exploited by Illegal Wildlife Trade syndicates to launder the proceeds of crime and any relevant regional trends or typologies.

- Ronald Zvendiya is a research and innovation analyst at Insurance and Pensions Commission (IPEC). For feedback: [email protected]

- Disclaimer: The opinions expressed in this article are solely the author’s and do not reflect the opinions and beliefs of IPEC or its affiliates.

- *These articles are coordinated by Lovemore Kadenge, past president of the Zimbabwe Economics Society and past president of the Chartered Governance & Accountancy Institute in Zimbabwe. Email: [email protected] and mobile No. +263 772 382 852