The concept of status quo bias, in the realm of behavioural economics, explains why individuals and nations often resist necessary change. A country of rich human capital and immense potential, Zimbabwe, today stands at the crossroads of economic reinvention.

In this article, I delve into the state of Zimbabwe’s economy, offering a review and commentary on key government policies, as well as chart a realistic yet hopeful path toward growth and psychological renewal.

The current state of Zim’s economy

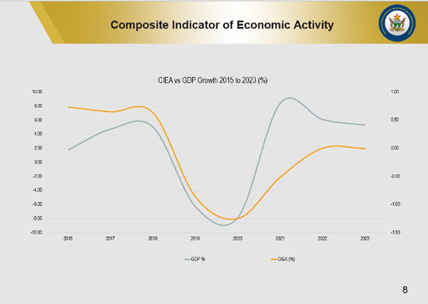

Zimbabwe’s economy has both suffered and undergone a turbulent journey over the past two decades, being marked by currency volatility, chronic fiscal imbalances and hyperinflation trauma.

Yet 2025, in its fifth month, shows tentative signs of recalibration.

Zimbabwe remains vulnerable to external and exogenous shocks such as climate-induced agricultural disruptions, regional political dynamics and commodity price fluctuations.

The economic environment, at a psychological level, is shaped by present bias and low consumer confidence, a tendency for households and businesses to focus on immediate needs rather than savings and future investment.

Progress, pitfalls, prospects in policies:

- Rampaging inflation hits Old Mutual . . . giant slips to $9 billion loss after tax

- Monetary measures spur exchange rate stability: RBZ

- Zim deploys IMF windfall to horticulture

- Banker demands $21m from land developer

Keep Reading

Policy initiatives taken by the Zimbabwean government over the past 18 months reveal a mixture of over-optimistic projections and pragmatic realism. In exploring the key pillars:

Currency reform

In 2025, the Reserve Bank of Zimbabwe (RBZ) launched the Zimbabwe Gold (ZiG), a new currency which was said to be backed by the country’s gold reserves and aiming to tame inflationary expectations and currency volatility.

Notable strengths of gold-backed credibility appeals to behavioural economics concepts of anchoring, providing a psychological “anchor” for citizens to gauge currency value.

However, the challenges of the transparency around gold reserves and governance remains critical because without credible auditing, the ZiG risks becoming another casualty of credence good failure where trust is essential but unverifiable.

Fiscal policy

In efforts to balance austerity and growth, the Zimbabwean government has made notable efforts to rein in fiscal deficits through:

- Enhanced tax collection (broadening the VAT base to 15%)

- Expenditure controls aimed at targeting a primary budget surplus

However, tax fatigue amongst struggling businesses and citizens poses risks. Behavioural studies in psychology show that perceived unfairness in taxation can erode voluntary tax compliance, thereby worsening public finances in the medium term.

Policy recommendations:

- Target wealth taxes at high-end assets rather than raising broad consumption taxes

- Increase transparency and visible public service delivery to improve tax morale

Re-engagement, debt arrears

Efforts to normalise relations with international financial institutions through the Structured Dialogue Platform are ongoing.

Positive signs relating to this include the willingness to engage in IMF staff-monitored programmes as well as the strengthening of debt data transparency.

However, the risks posed by this is the moral hazard because without domestic reform commitment, the external financial support can encourage complacency.

Policy psychology

- It is essential to note the reason why consistency beats charisma. One of Zimbabwe’s deepest economic challenges is its abrupt shifts in currency regimes, policy inconsistency, land policy, and property rights which have deeply-embedded hyperbolic discounting behaviours in economic actors.

- The psychological impact of this is that businesses make short-term decisions to survive today rather than invest for tomorrow and households prefer hard assets (gold, real estate) over savings accounts.

Restoring trust requires consistent, rule-based governance, independent institutions (especially the central bank and judiciary) and clear, simple, and predictable policies that align incentives toward long-term investment. This is not just economic reform but a psychological reconstruction.

Sustainable growth

Different sectors offer varying prospects under current policy conditions, the current highlight being the mining and the green revolution as Zimbabwe’s lithium deposits place it at the centre of the green energy value chain globally.

Smart policies which prevent the resource curse through beneficiation, good governance and community royalties could turn mining into a transformative engine.

Behavioural shifts

Zimbabwe’s economic future hinges not just on better policies, but on changing collective psychology through changing from scarcity mindset to the growth mindset.

Decades of survivalism have conditioned individuals and businesses into a scarcity mindset the belief that opportunities are rare, resources finite and risks always outweigh rewards.

To foster a growth mindset, Zimbabwe must celebrate success stories of entrepreneurship and innovation, expand financial inclusion to empower risk-taking, reform education to emphasise resilience, creativity, and critical thinking and continuously build platforms for youth participation in economic policy dialogues.

The field of positive economic psychology reminds us that optimism, resilience, and agency are the critical drivers of performance both individually and nationally.

Rewiring for tenewal

Zimbabwe is not trapped by fate. Its history, human capital and resources position it for overflowing success if it could align policy choices, collective economic psychology and governance reforms, toward its shared goals.

The work is evident and already underway: key sectors show life and international re-engagement is progressing. But progress is fragile and demands vigilance.

As economists such as Dani Rodrik remind us, “good governance is not a luxury of prosperity; it is a foundation for it”.

Zimbabwe’s next chapter will be written not by singular leaders, or foreign donors but by the daily choices of its citizens, entrepreneurs and policymakers.

In the end, the greatest reform is the belief and practice that better is possible. Zimbabwe’s economic renewal is not an event. It is a journey of pragmatic hope.

- Mahagwe is a hospitality entrepreneur in Zimbabwe, a systemic family therapist, and a deputy manager in health and social care sector in the UK. These weekly New Horison articles published in the Zimbabwe Independent are coordinated by Lovemore Kadenge, an independent consultant, managing consultant of Zawale Consultants (Private) Limited, past president of the Zimbabwe Economics Society (ZES) and past president of the Chartered Governance & Accountancy in Zimbabwe (CGI). Email - [email protected] or mobile +263 772 382 852