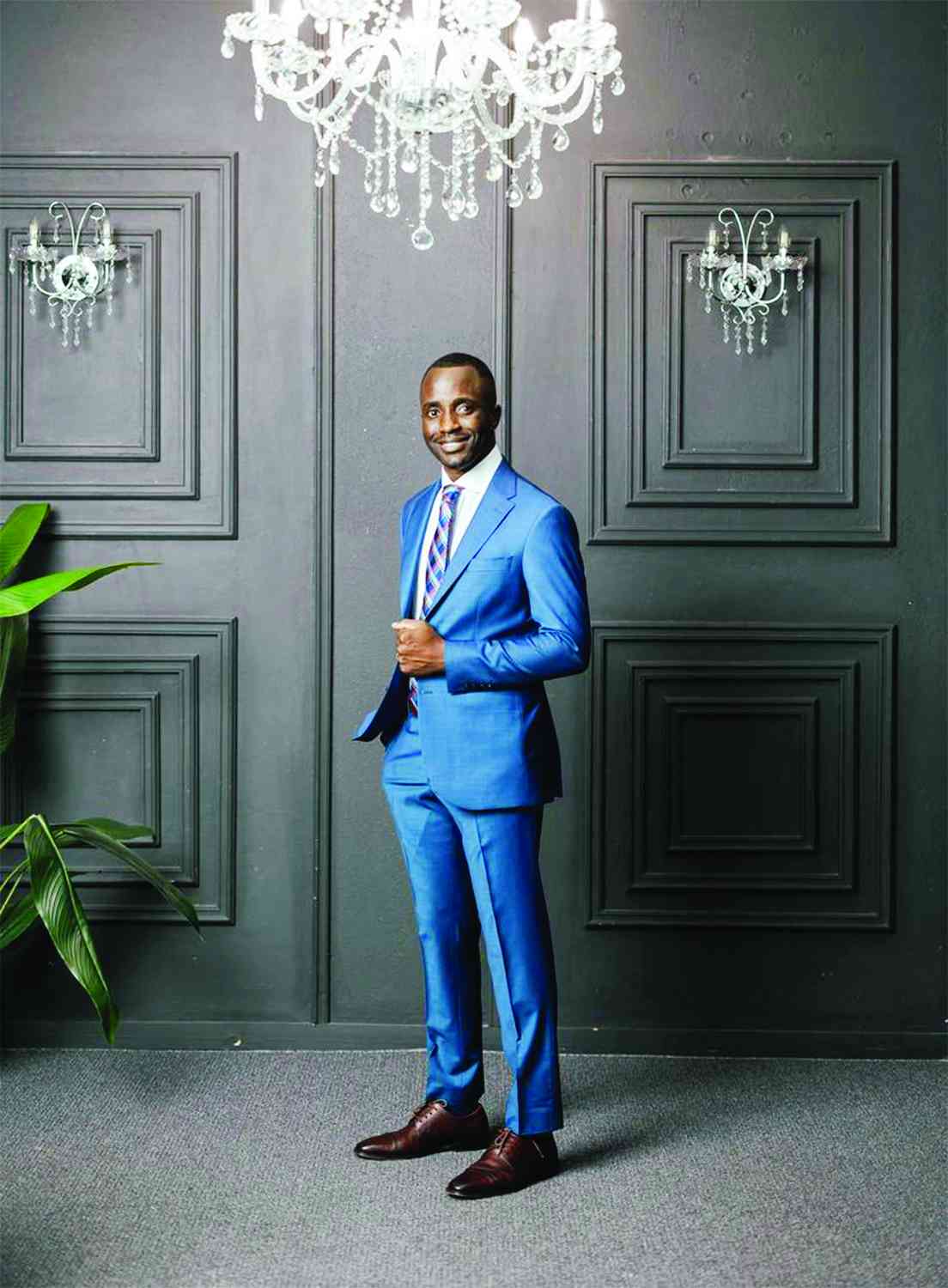

At 37, Brian Kudzaishe Mataruka is one of Zimbabwe’s youngest executives. He was recently appointed chairperson of Willdale Limited, the brick-making giant. His appointment came as Zimbabwe’s construction sector continues to grow, underpinned by a huge housing backlog and government projects. Mataruka tells our deputy news editor Sydney Kawadza (SK) in the interview below, that his firm has been at the forefront of this expansion. Kawadza began by asking him about his vision for the business, whose impact is felt from domestic consumers to companies, before moving on to discuss Zimbabwe’s complex business environment. Here is how the Willdale boss sees the business climate today. He also gives insights into his growth plan:

SK: As the newly-appointed chairperson of Willdale, please share with us your vision for the company?

BM: My vision is to ensure that we retain our position as the largest brick manufacturer in Zimbabwe, fostering a positive contribution in the Zimbabwean construction sector that promotes infrastructure development, through quality clay brick craftsmanship, sustainable and eco-friendly practices, with a commitment to excellence that stands the test of time.

SK: You are likely one of the youngest board chairpersons in Zimbabwe’s corporate sector at 37. What does this mean to you, and how do you intend to leverage this during your tenure at the helm of Willdale?

BM: I am grateful for the opportunity that has been extended to me and intend to ensure that I am a beacon of light of what young people can achieve in Zimbabwe. In my view, having young faces in leadership can enhance a company’s image as a progressive, inclusive, and forward-thinking employer, which helps in attracting top young talent. Mixing younger leaders with experienced more senior executives creates intergenerational balance, encouraging richer discussions and better rounded decisions.

SK: You have served on Willdale’s board for several years. What can you say about the business environment in your industry? Could you also tell us about your production capacity?

BM: The business environment has been difficult and we have seen a number of large and small-scale companies close down after having failed to navigate the challenges that the business environment has been presenting. As Willdale, we continue to manage and navigate through these challenges and we are actually focused on retaining and growing our market share. The current production capacity is 100 million bricks per annum.

SK: What have been your major milestones so far?

- Companies hopeful of improved operating environment in 2023

- Willdale banks on construction boom

- Willdale appoints new chair in flurry of board changes

- Willdale seeks strong comeback in 2025

Keep Reading

BM: We have managed to grow our brand to become the preferred brand for most projects, particularly large projects. We pay attention to the quality of our products and to that end, in 2023 we attained ISO certification in quality, health and safety and environment.

SK: What challenges are you facing?

BM: Our challenges are on production efficiencies and we need to acquire a modern plant that produces efficiently and at a lower cost. This will enable us to be more competitive in the lower rung of the market.

SK: What is your production outlook for 2025?

BM: We hope the liquidity situation will improve in the short term, which will then stimulate growth in production, especially from the individual home developers who have been a consistent source of sales over the years. We are excited by the planned government projects and the commitment by the government, Afreximbank (Africa Export Import Bank) and local banks to fund infrastructure projects. We are keeping a close eye on the developments being pioneered by banks such as CBZ and FBC.

SK: How do you view the future of Zimbabwe’s construction industry?

BM: The future is bright and we have a positive outlook on the Zimbabwean construction sector. The housing backlog continues to balloon with increasing demand, which has outstripped supply. There is also a backlog in the construction of schools and hospitals.

SK: How much capital expenditure have you allocated for 2025?

BM: Our capex (capital expenditure) budget is about US$4 million and this is mainly to fund the new all-weather plant.

SK: Inflation and economic volatility remain major hurdles for businesses in Zimbabwe. How is Willdale mitigating these risks?

BM: Managing a business in Zimbabwe requires smart, proactive strategies to protect business value and ensure continuity. Some of the strategies that we are employing as Willdale include cost rationalisation, to ensure that the costs of production are controlled in a way that ensures maximum profitability, build flexibility into pricing to respond quickly to inflation, and investment in technology to ensure production and operational efficiency. This is why we have made a decision to invest in an all-weather plant, which is a technologically-advanced way to expand into the regional market with a specific focus on Zambia and Mozambique to ensure maximum foreign currency generation to fund capital expenditure and growth.

SK: You face competition from traditional rivals, informal brickmakers and Chinese investors. How is Willdale maintaining its competitive edge?

BM: We intend on continuing to leverage on our relationships with local industry as Zimbabwean natives. We, as Zimbabweans, should be seen to be taking the front seat in the development of our country and our infrastructure. There is a boom in the housing sector with clusters and flats being built to cater for the ever-increasing urban population. On our part, we are developing our real estate assets to create a second revenue stream from the traditional business model. We have partnered with leading developers in this sector to assist us in navigating a business environment that we are traditionally not familiar with. For instance, partnerships with state institutions such as universities in their infrastructure needs and providing them with high quality low-cost bricks, promoting the use of face bricks as opposed to traditional common bricks, whose use over time is, in fact, more expensive given the maintenance costs of plastering and painting, and fostering partnerships with developers in large-scale commercial developments that have the capacity to consume high volumes of bricks.

SK: How would you describe your relationship with government authorities, including Treasury and the Reserve Bank of Zimbabwe?

BM: We have been working well with the government as both a customer and a regulator. Given that we are one of the key members of the Mt. Hampden new city community, we must ensure that we do our part in promoting the development of the new city into a world-class administrative capital. We are going to ensure that we foster strong ties with government bodies to ensure that we have a win-win situation, in which we all get value from the relationship from the government as both a client and a regulator.