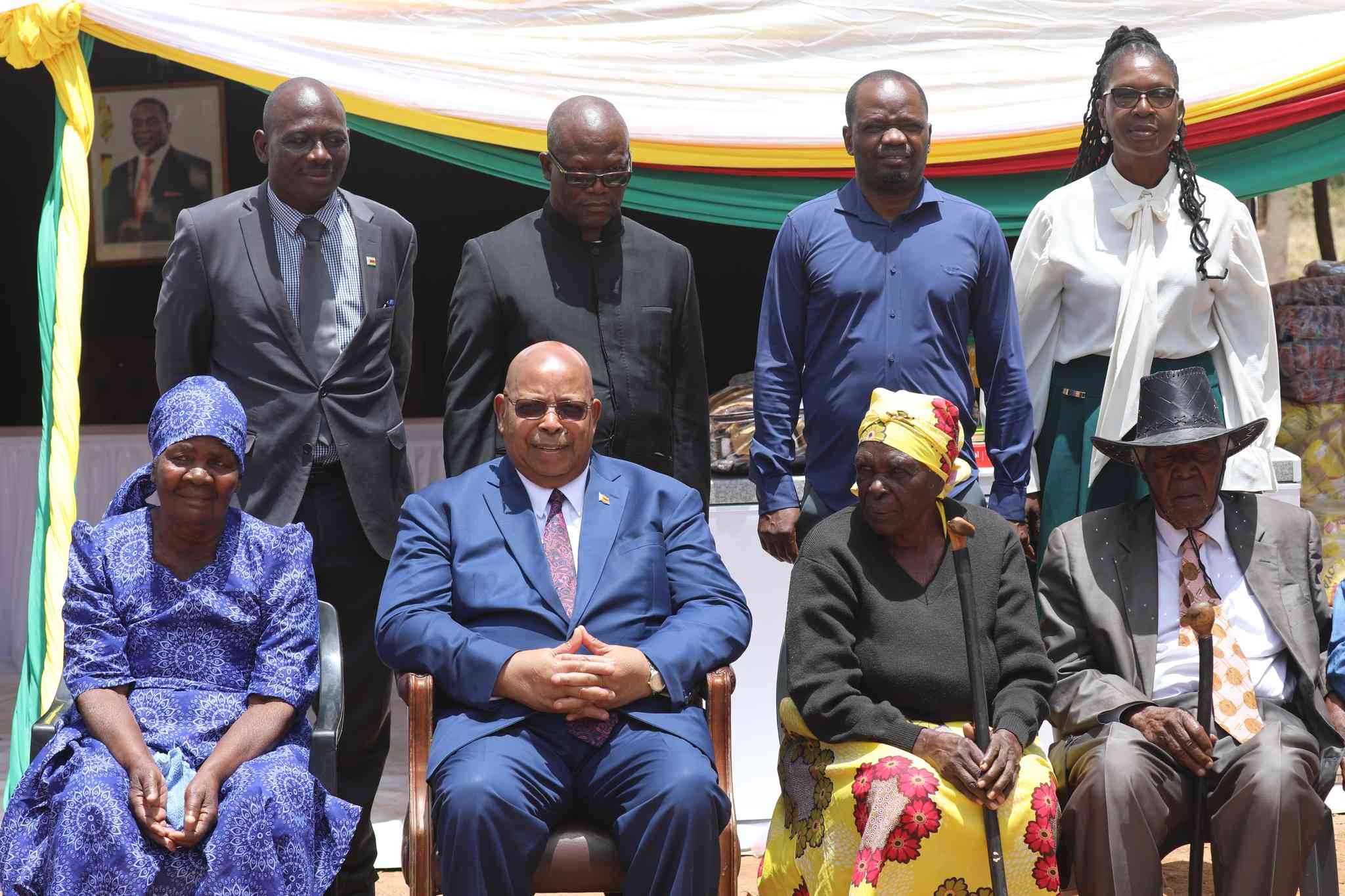

THE International Labour Organization (ILO) recently held a second certification ceremony for trainers and entrepreneurs who completed its Financial Education programme.

The programme, funded by the African Development Bank, aimed to empower women and youth through sustainable enterprise development in Zimbabwe.

The first certification ceremony was held last week.

Twenty-two trainers and 250 entrepreneurs were awarded certificates.

Speaking at the ceremony, ILO national protect manager Fortune Sithole emphasised the significance of financial education in driving economic growth and improving livelihoods.

“Financial education equips women and youths with the knowledge and tools necessary to navigate the complexities of money management, the financial sector and employing a wide range of financial competencies,” he said.

The programme, which trained 1 017 entrepreneurs (668 women and 349 men), focused on building financial literacy skills, including setting financial goals, budgeting, and managing debt.

The project also generated 2 246 jobs (1 196 for women and 1 050 for men) and developed the capacity of government officials and business development service providers.

- Renault hands Russian assets to Moscow

- New perspectives: Building capacity of agricultural players in Zim

- News in depth: Mnangagwa’s push for $12 billion mining industry imperils communities

- New perspectives: Building capacity of agricultural players in Zim

Keep Reading

The ILO Financial Education programme aligns with several national and international development frameworks, including the Decent Work Country Programme, National Development Strategy 1 and the Sustainable Development Goals.

By fostering entrepreneurship and financial literacy, the program aims to drive economic growth and improve livelihoods, particularly for marginalised groups.

Bulawayo Provincial Affairs and Devolution minister Judith Ncube, represented by director of co-ordination in her office, Boetsoarelo Noko, applauded the programme, highlighting that entrepreneurs have managed to access new market opportunities.

She added: “Empowerment through financial education is not merely a goal; it is a necessity.

“It is crucial that we recognise the transformative power that financial management holds for women entrepreneurs in our society.

“Statistics reveal that women in Zimbabwe are increasingly taking up roles as entrepreneurs, decision-makers and leaders within their households.”

The second and final ceremony comprised 12 trainers and 150 entrepreneurs who were awarded certificates of completion.