PRESIDENT Robert Mugabe’s recent appeal for foreign direct investment (FDI) confirms his Zanu PF administration is failing to turn around the economy which is in a depression, analysts said this week. MTHANDAZO NYONI OWN CORRESPONDENT

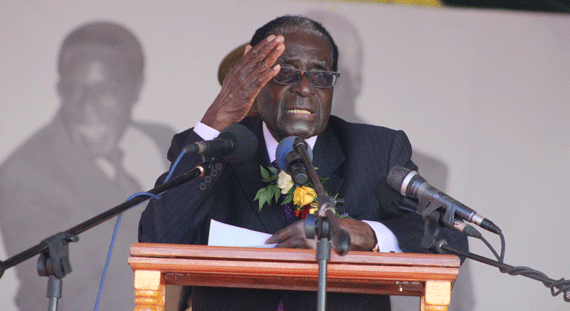

Officially opening the Zimbabwe International Trade Fair last week Mugabe appealed for more FDI to stimulate Zimbabwe’s underperforming economy, promising to respect property rights for investors.

FDI is a direct investment into production or business by an individual or company in another country.

The country has struggled to attract FDI in recent years or funding for its economic blueprint, ZimAsset due to concerns over the perceived lack of respect for property rights and uncertain business climate.

Economic analysts, business lobby groups and trade unions who spoke to Southern Eye Business on Friday said Mugabe and his party have realised that their economic policies will not bring anything tangible to revive the economy.

They argued that the party’s manifesto was too broad and lacks the finer detail necessary to spell out exactly how the economic agenda would be executed.

Economic analyst Eric Bloch said Mugabe and his party had realised that they could not resuscitate the comatose economy, hence the call for FDI.

“He (Mugabe) has finally realised that there are no prospects for economic recovery as the economy is in the low for so many years. The party has to create policies that will attract FDI. They have to make some changes in the country’s tax system, indigenisation policies and labour legislation should be fair for both employer and workers. This will help for economic recovery,” Bloch said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Another economic analyst, Collen Mugozva said it was necessary for Zanu PF party to lure for FDI because the Look East policy was not bearing fruits.

“For us to create jobs we must have capital, but in Zimbabwe we do not have it. The people we hoped will come and assist are not forthcoming or have been reluctant to assist. They (Zanu PF government) have realised that they need capital and this is the reason why they call for FDI,” Mugozva said.

Affirmative Action Group Matabeleland Chapter president Roy Sibanda said the president was calling for FDI because the country needs cash for the resuscitation of dying industries.

Lucky Mlilo, the chief executive officer of Association for Business in Zimbabwe said FDI was crucial for developing countries like Zimbabwe for economic recovery and it was impossible for the country to survive without it.

“FDI is needed and we need to come up with policies which are investor friendly to attract foreign investment. We have to deal with the outside world to overcome challenges like liquidity crunch,” Mlilo said.

He said the country has to emulate other countries like Angola who have succeeded through FDI.

The Zimbabwe Congress of Trade Union secretary-general Japhet Moyo said the call for FDI by Mugabe was crucial, but he should first deal with inconsistent policies.

“If we look at the programmes that we have in the country they don’t attract FDI because if you need foreign investment you need to create conducive environment. Policies such as ZimAsset are not clear and they will not attract FDI and we have witnessed it over the years,” Moyo said.

ZimAsset is the government’s economic blueprint adopted from the Zanu PF 2013 election manifesto.

Zanu PF was silent on the country’s tax system, which has caused an outcry in the private sector.

The mining industry, for example, has been reeling from a plethora of challenges, including a tax regime that has stifled growth.

In the run-up to controversial July 31 elections, Mugabe and Zanu PF unveiled an election manifesto in which they promised Zimbabweans heaven on earth.

The party promised creating value of $7,3 billion from the indigenisation of 1 138 companies across 14 key sectors of the economy and over $1,8 million from the idle value of empowerment assets unlocked from parastatals, local authorities, mineral rights and claims and from the State to capacitate Agribank with $2 billion to finance the stimulation of agricultural productivity.

These initiatives were said to be aimed at creating over two million jobs across key sectors of the economy and contributing to export earnings, food security and to the fiscus among many other benefits including urban housing and construction or peri-urban farms acquired during the land reform exercise.

A massive public infrastructure rehabilitation programme was also promised, premised on a $3 billion injection.

The party also said it would pump into small enterprises $300 million and sell off non-performing State firms to unlock up to $7,6 billion.

The party’s trump card — the empowerment drive — was expected to unlock $1,8 trillion into locals’ coffers and drive annual gross domestic product growth close to 10% by 2018, from the current 4,4%.

However, ten months down the line Zimbabweans continue to sing the blues.