JERSEY miner, Caledonia Mining Corporation plc (Caledonia) has delayed publishing its 2024 annual report to restate its financial results with respect to tax obligations concerning its Blanket Mine (1983) (Private) Limited subsidiary.

According to Caledonia, transactions from the annual and interim periods between January 1, 2019 and September 30, 2024, affected the deferred tax liability calculation as it continued to be denominated in RTGS$, in accordance with the legislated tax regime.

This was even after the multi-currency regime was introduced.

The accounting for the deferred tax liabilities in RTGS$ with the translation to US dollar remained consistent in all previous consolidated financial statements, yet the carrying value of the deferred tax liabilities should have been denominated in US dollars rather than RTGS$.

Consequently, the firm is reviewing its financial results.

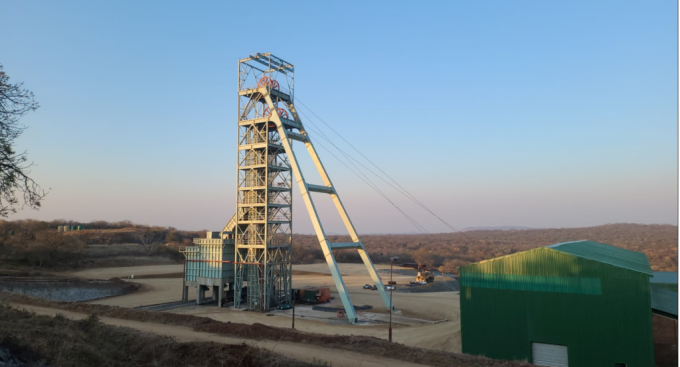

Blanket Mine (1983) (Private) Limited owns Caledonia’s best gold producing mining outfit, Blanket Mine.

“Caledonia Mining Corporation plc is filing this notification of late filing on Form 12b-25 with respect to its annual report on Form 20-F for its fiscal year ended December 31, 2024 (the 2024 Annual Report) with the Securities and Exchange Commission (SEC),” Caledonia said in a filing to the United States SEC.

“Despite working diligently in an effort to timely file its 2024 annual report, the company has been unable to complete all work necessary to timely file its 2024 annual report.”

- Tough rules for capital markets key in containing inflation, says Seczim

- SecZim okays new rules on trading contracts

- Piggy’s Trading & Investing Tips: Cards or shares?

- SecZim shakes up capital markets

Keep Reading

Caledonia said it disclosed this in a Press release furnished to the United States SEC on March 31, 2025.

“The company’s previously issued financial statements for the annual and interim periods between January 1, 2019, and September 30, 2024, are being restated, which contributed to delays in the completion of the preparation and issuance of the 2024 annual report,” Caledonia said.

“The previously issued financial statements will be restated with respect to the accounting of deferred tax liabilities of the company’s subsidiary Blanket Mine (1983) (Private) Limited in Zimbabwe which owns the Blanket Gold Mine.”

However, the firm said the restatement had “no effect on historic reported cash or cashflow statements and has no effect on historic income tax calculations or submissions to tax authorities”.

“In connection with the preparation and audit of the company’s consolidated financial statements, the company has identified material weaknesses in the company’s internal controls over financial reporting and disclosure controls and procedures for the fiscal years ended December 31, 2019, 2020, 2021, 2022, 2023 and 2024, with remediation efforts currently ongoing and expected to be completed in the second quarter of 2025,” Caledonia said.

These material weaknesses, NewsDay Business understands, were disclosed in the Press release furnished to the SEC.

“The company cannot eliminate the reasons causing the inability to file timely without unreasonable effort or expense,” Caledonia said.

“Accordingly, the company anticipates that it will file the 2024 annual report within the 15-day grace period provided by Exchange Act Rule 12b-25.”